does indiana have estate or inheritance tax

Reform and repeal of estate and inheritance taxes have been very frequent in the last few years sometimes in states you might not expect. States have typically thought of these taxes as a way to increase their revenues.

State Estate And Inheritance Taxes Itep

If you have any questions concerning the repeal of the Indiana Inheritance Tax the administration.

. At this point there are only six states that impose state-level inheritance taxes. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. 4 The federal government does not impose an inheritance tax.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Kentucky and New Jersey are close behind with top rates of 16 percent. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

How Much Tax Will You Pay in Indiana On 60000. Indiana does not have an inheritance tax nor does it have a gift tax. This is great news if you live in the Hoosier state.

An estate worth less than 50000 will not need to go through probate. These taxes may include. This means they will need an affidavit to prove they are entitled to the assets which.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Indiana is one of 38 states in the United States that does not have an estate tax. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. For deaths occurring in 2013 or later you do not need to worry about Indiana inheritance tax at all.

However many states. Indianas inheritance tax still applies. For individuals dying before January 1 2013.

Does Indiana have an estate tax. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. The following is a description of how the tax worked for deaths that occurred prior to 2013.

States Without Death Taxes. A federal estate tax is in effect as of 2021 but the exemption is significant. On the federal level there is no inheritance tax.

If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an individuals estate are required for those dying after December 31 2012.

The top estate tax rate is 16 percent exemption threshold. Twelve states and Washington DC. Impose estate taxes and six impose inheritance taxes.

For those who do not plan the amount of Federal Estate Tax that will be required to be paid can approach 50 of the amount in the Estate over the 525 million. Does Indiana Have an Inheritance Tax or Estate Tax. They can help you understand estate or inheritance taxes and your obligation to pay the tax and fill out.

Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. Maryland is the only state to impose both. Federal Estate Tax.

However be sure you remember to file the following. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. The decedents surviving spouse pays no inheritance tax due to an unlimited marital.

Probate may be required in Indiana if the estate doesnt meet some basic rules. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec.

Indiana used to impose an inheritance tax. For more information please join us for an upcoming FREE seminar. Federal estatetrust income tax.

117 million increasing to 1206 million for deaths that occur in 2022. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. The amount can be doubled for a married couple with properly drafted Wills or Trusts. Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states.

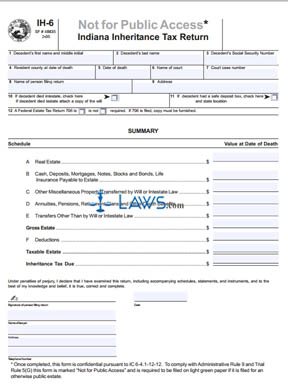

In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance tax you should seek the counsel of an estate attorney.

Instead they will use the small estate administration to transfer ownership of the assets to the heirs. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Therefore no inheritance tax returns must be filed at this time.

In 2013 Indiana sped up the repeal of its. No tax has to be paid. This tax ended on December 31 2012.

The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206 million in 2022.

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Death Tax Is A Killer The Heritage Foundation

Is There A Federal Inheritance Tax Legalzoom Com

States With Inheritance Tax Or Estate Tax Bookkeepers Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Free Form Ih 6 Indiana Inheritance Tax Return Free Legal Forms Laws Com

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Is Your Inheritance Considered Taxable Income H R Block

A Complete Guide To Inheritance Tax Taxact Blog

State Estate And Inheritance Taxes Itep

Calculating Inheritance Tax Laws Com